No matter your day job, we all have a second gig that saps a couple of hours from our lives every month: operating the administrative branch of your life (or your household). Personal bureaucracy is a sad fact of life, but there are several ways to make it less hair-wrenchingly confusing. Today we're looking at four different services that organize much of your billing and account information online.

The most popular of these may be Mint, but that's primarily a budgeting resource—not a bill-filing, subscription-tallying, doctor-managing, all-in-one. For a thorough way of keeping tabs on everything in your life, here are a couple of options to be used in harmony with each other. All of them are slightly different, some may not fit your needs, but all have fit mine quite well.

Income and spending management

The aforementioned Mint is good at breaking apart your monthly expenses, and Adaptu is less well-known but offers a similar product. Budgeting is a tricky service to offer: I've used many different apps and found that logging into reminders about what I'm doing wrong rarely make me interested in doing anything right. Rather, the red marks in my transactions column just make me interested in closing the window or shutting off the app.

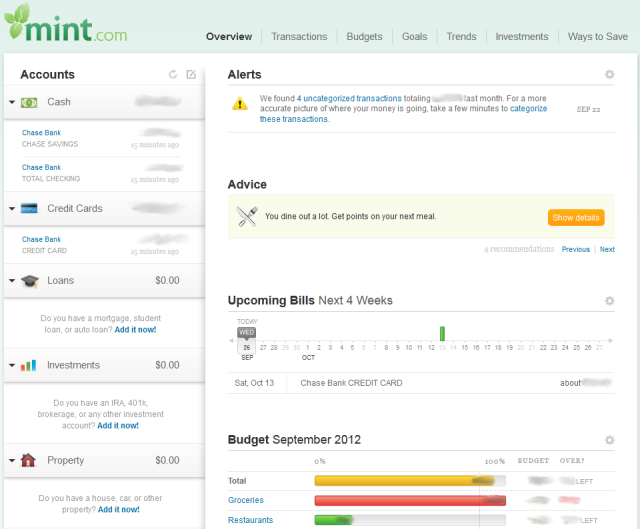

But I'll admit that Mint is good at what it does, and the slick interface and workable app makes it not awful to deal with. After you create an account and link your bank accounts and investment accounts to it, Mint automatically breaks down your purchases and uses them to populate categories such as groceries, restaurants/dining, clothes, transportation, etc. so you can get a good look at how you've spent throughout the course of the previous month. It will also group unclassifiable things, like checks to your landlord or purchases from obscure companies, so you can manually categorize them.

You can also use Mint to set goals for yourself. Some people really like this feature, but I find it a bit limited. Mint walks you through a number of preset goals like "save for an emergency" or "save for a vacation." Enter how much money you'll need and when you'll need it, and Mint calculates how much money you'll need to save each month to achieve your goals by that set time. This is all well and good, but I'd love to see a feature that lets you vary the amount you set out to save each month—instead of saying to me "You need to save $238 dollars every month," let me promise that I'll save $100 in December around the holidays, but $268 for the 5 months after that. (Also, Mint lets you set up unattainable goals, which is just asking for me to feel disappointed down the line).

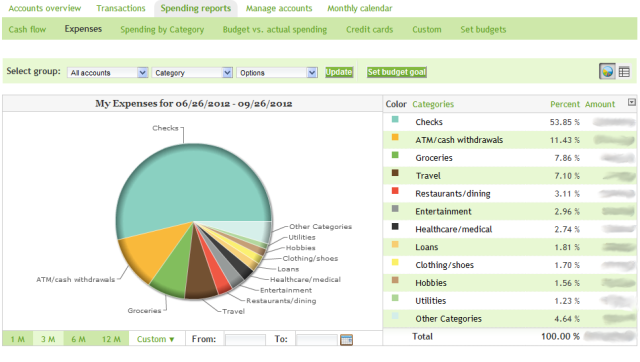

Similarly, Adaptu links to your bank accounts, and may work better for people using credit unions or alternative banking systems than Mint (though stuffing all your money in a mattress is not recommended). You set up a user name and password, and answer three security questions. Then every time you sign in, you're prompted for your password and an answer to one of those three questions. Then, like Mint, you link your bank accounts in your profile, and Adaptu will set up a page recording your transactions. It separates them by spending category and classifying the unknowns as such for manual entry later.

Aesthetically, Adaptu is a little less slick than Mint but it also offers graphical representations of your monthly expenses to show how much you're spending in each category (even how much you're spending or saving compared to national data). One great thing about Adaptu is that you can set up manual accounts, something Mint doesn't permit (although you can manually add individual transactions through the Mint mobile app, you can't manually set up whole accounts). I have an account through my city's credit union, so the manual accounts feature is great for me to keep tabs on what I take and add regularly to that account. With Mint, you're stuck primarily seeing how much credit you've withdrawn from big banks, although soul-sucking is generally not included in that credit tally.

Of course, both Mint and Adaptu say that if you suggest a bank to them, they'll try to work out a deal with that bank to get it registered. But the smaller the bank is, the less incentive there is for either party to put time and effort into getting linked.

Adaptu also gives you a calendar view of when your transactions go through, and lets you add future payments to that calendar. This would be an awesome feature, but it seems to only record when transactions are registered by your bank. That's not quite as useful if you want to see how much damage you do on a Sunday on average. In this regard, Mint is much better at showing you trends in your spending.

But not all value is counted in dollars and cents—Adaptu seems to want to branch out of the solid income-and-spending-management gig. First, it lets you link your rewards accounts like mileage programs with airlines so you can keep tabs on them. Second, in the mobile app you're able to snap images of your insurance cards or business cards so you can leave them at home when you go out. This does add slightly more functionality than Mint. But if you're going to start keeping tabs on non-monetary value that you acquire, you may want to skip Adaptu's half-measures and choose a service that's going to cover more of the hundreds of rewards programs out there.

Rewards and subscriptions

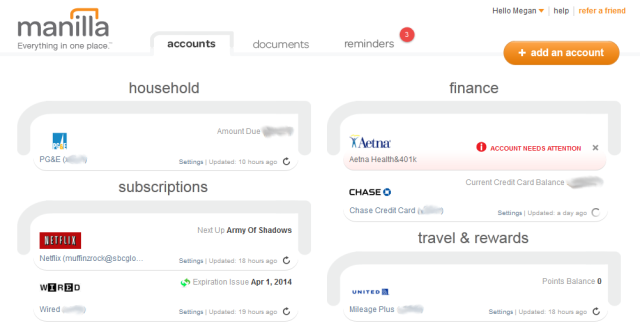

Speaking of those rewards, Manilla is the pre-eminent company offering an online file-folder for subscriptions, bills, and reminders. Manilla often seems to be mistakenly compared to Mint, though once you use it you'll see it's totally different.

Create a username and password, then Manilla lets you link all your accounts from around the Web. This means utility bills, phone bills, rewards cards, magazine subscriptions, investment accounts, even Netflix subscriptions, in addition to your standard credit card bills. When a linked account would normally forward you a bill or a statement, that bill and statement will also end up as a PDF in your "Documents" tab in your Manilla account.

The Documents tab in Manilla is, in my opinion, the main draw. Bills and statements that are sent there are stored in your account indefinitely (as long as you keep your Manilla account running), and storage is unlimited. This is great because it will keep records from past accounts, even if you've discontinued service months or years ago and no longer have an account with that company (generally, if you cancel your AT&T service, for example, you can no longer access past records on AT&T's website. Manilla makes that possible). Rather than lose all that information, or have to keep weighty paper documents of phone bills, Manilla keeps everything stored online for you to download at any time.

In some limited instances, Manilla also cuts down on your physical mail. The company has partnerships with AT&T, Citibank, Comcast, and DIRECTV. So when you link any of those four accounts to Manilla, it notifies you that you'll be signing up to get an electronic statement only, through the Manilla interface. This may not be ideal for many, so make sure it's what you really want before linking those accounts. Forcing customers onto paperless billing is part of how Manilla makes money (they receive a commission from the companies that no longer have to spend money on postage and printing). For some companies outside of the four mentioned above, you can use Manilla to sign up for paperless billing on the billing company's website. Personally, I love having neither my personal inbox nor my mailbox cluttered with bills and mailers. But again, the set up may not be for everyone.

It's worth noting that you can't actually pay your bills through Manilla, but for many accounts the service includes a "Pay Bill" button that takes you directly to the biller's website (after installing a browser plugin from Manilla).

The service lets you link over 3,500 accounts, but you'll still probably be able to find some gaps in coverage. Weirdly, I was able to link my Wired magazine subscription, but not my Vogue subscription (both magazines are owned by the same publisher—Conde Nast—which, incidentally, also owns Ars). Manilla says it's working on adding more accounts every day and it takes suggestions. So in the event that you have accounts left out in the cold, I've found a workaround by assigning "Reminders" for due dates that I know are coming up.

For example, I have a car loan with the same credit union that I referenced earlier. I can't link my credit union through Manilla's website, but I set up a reminder through Manilla asking it to text me (you can also simply have Manilla e-mail you) on the 14th, the day before my loan payment is due.

The doctor is in

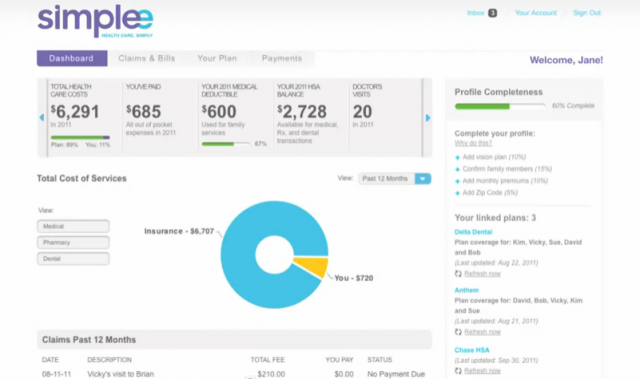

If you're lucky enough to have health insurance, and especially if you're self-employed or have multiple people on your insurance, Simplee is a service that breaks down your medical bills into data that is surprisingly easy to understand. Again, set up an account, and link your health insurance account, and Simplee—just like Mint and Adaptu and Manilla—will automatically import all your bills and statements and break them down into easy-to-read graphs showing your total healthcare costs, how much of that you owed, your deductible, how many doctor's visits you've made, and the number of transactions that have occurred. Underneath this information is a graph to help you visualize your expenses, and a list of claims made in the past year.

Simplee is different from the account management services above, however, in that you can use it to send actual payments to your doctors. Although you're free to send a check to the doctor through the mail, you can also input the doctor's address, use a credit card or debit card to pay Simplee, and Simplee cuts a check and sends it to your doctor. Sure, it's an extra step between the doctor getting paid, but it's free and if you don't have a check book lying around it's easy.

The service also helps you find doctors in your area—something that many insurance companies make unbearably difficult through their own sites. When you search, however, Simplee doesn't always give a breakdown of which insurance providers doctors are currently accepting. So when you call to make an appointment, it's always good to double-check that the doctor's office still accepts your insurance provider.

Making it all work

Ideally, with these four services you can reduce the number of websites you have to log into (especially with Manilla) on a daily basis, and know with a glance the status of all of your accounts. None of the four services above are perfect, but it's simply good practice to keep tabs on your health insurance bills, subscriptions, credit lines, and expenses, which can get hard if you're busy. Of course, there's overlap between all of these companies, so figuring out what combination of services works for you is a personal journey.

reader comments

78